Is the UK Net Zero Carbon Buildings Standard (NZCBS) the New Arbitrator of Value?

The End of Theoretical Sustainability

The United Kingdom real estate market has arrived at a definitive inflection point, marking the transition from a period of fragmented, voluntary green certifications to a rigorous, science-based performance regime. For decades, the lack of a unified definition for Net Zero has allowed for a proliferation of claims based on theoretical design potential or the use of inexpensive carbon offsets (NZCBS, 2026). This ambiguity has frequently facilitated greenwashing and complicated the assessment of investment risk.

The introduction of the UK Net Zero Carbon Buildings Standard (NZCBS), which will see the publication of its definitive Version 1 in early March 2026, represents a watershed moment for fund managers and institutional investors. By providing a technical rulebook for the 1.5°C transition, the Standard establishes a binary indicator of asset survival in a decarbonising economy (Bureau Veritas, 2026).

The NZCBS is the product of an unprecedented cross-industry coalition, including the Royal Institution of Chartered Surveyors (RICS), the Royal Institute of British Architects (RIBA), and the UK Green Building Council (UKGBC). Its technical architecture is derived from a methodology known as the Balancing Model (NZCBS, 2026). This model operates through a dual approach: a top-down component that apportions the UK’s remaining national carbon budget to the built environment, and a bottom-up analysis of many datasets evaluating the technical feasibility of decarbonisation across various building typologies (NZCBS, 2026).

Strategic importance for asset managers lies in the fundamental shift from design-for-compliance to performance-for-verification. Historically, the sector has suffered from a performance gap: the significant discrepancy between a building’s designed energy efficiency and its actual operational consumption (AtkinsRéalis, 2026). The NZCBS renders Energy Performance Certificates (EPCs) and design-stage BREEAM ratings insufficient for future due diligence. Instead, it mandates verification based on 12 months of metered, in-use operational data (NZCBS, 2026). This transition ensures that an asset’s status is grounded in the reality of its operation rather than its design intent, forming the basis for a new technical architecture of alignment.

The Technical Architecture Whole Life Carbon and Operational Rigour

The NZCBS adopts a Whole Life Carbon (WLC) approach, reflecting a non-negotiable requirement for institutional-grade assets to address both embodied and operational emissions (Greengage Environmental, 2026). This holistic perspective ensures that carbon reductions in building operations are not achieved at the expense of high-emission construction materials. To achieve the designation of Net Zero Carbon Aligned, an asset must satisfy mandatory limits across multiple technical metrics, including refrigerants, peak demand management, and fossil-fuel-free (NZCBS, 2026).

The primary metric for operational rigour is Energy Use Intensity (EUI), measured in kWh/m² per year (GIA). Crucially, the Standard’s EUI scope encompasses all energy consumed within the building boundary. This includes regulated loads (such as heating and cooling) and unregulated loads (including tenant IT equipment, catering, and servers) (Max Fordham, 2026). By capturing tenant-controlled energy, the Standard fundamentally expands the landlord’s operational scope and necessitates a deep understanding of how a building is used in practice.

Data from the Pilot Programme (2025-2026) revealed the severity of this shift, particularly in the residential sector. For instance, Max’s House, a verified Passivhaus project, struggled to meet the stringent EUI limits (45 kWh/m²) because unregulated energy use from occupant behaviour (cooking, IT) often exceeds the narrow margins left after heating and lighting are accounted for (CIBSE Journal, 2026).

The targets within the Standard are aggressive, as evidenced by the trajectories set for the office sector. The following table illustrates the tightening EUI limits required for certification.

Energy Use Intensity (EUI) Limits for Offices (kWh/m²/year GIA)

Asset Category | 2025 Target | 2050 Target | Strategic Assessment |

New Build Office | 85 | 45 | Highly challenging: requires fundamental design shifts. |

Retrofit Office (One-go) | 100 | 55 | Achievable with deep refurbishment and facade upgrades. |

(Source: Verco, 2026; UKNZCBS, 2026)

The technical architecture also creates a significant Retrofit Incentive. The Standard imposes much stricter upfront embodied carbon limits in 2025 on new built offices (approximately 735 kgCO₂e/m²) compared to refurbishment projects at 600 kgCO₂e/m² (Greengage Environmental, 2026). For example, while a new school faces a limit of 530 kgCO₂e/m² in 2025, a new school built in 2050 must reach 45 kgCO₂e/m² (NZCBS, 2026). This regulatory pincer movement, which combines high carbon costs for new construction with slightly more flexible EUI targets for existing stock, strongly favours the retention and deep refurbishment of the UK’s building fabric.

However, the Pilot Programme identified a potential supply chain bottleneck: many standard concrete-frame residential and school projects failed the 2025 embodied carbon caps, signalling a mandatory shift toward timber and low-carbon concrete (CIBSE Journal, 2026). Furthermore, the Standard introduces granularity in sectors like logistics, distinguishing between unconditioned storage and cold store facilities to ensure fair benchmarking (Savills, 2026).

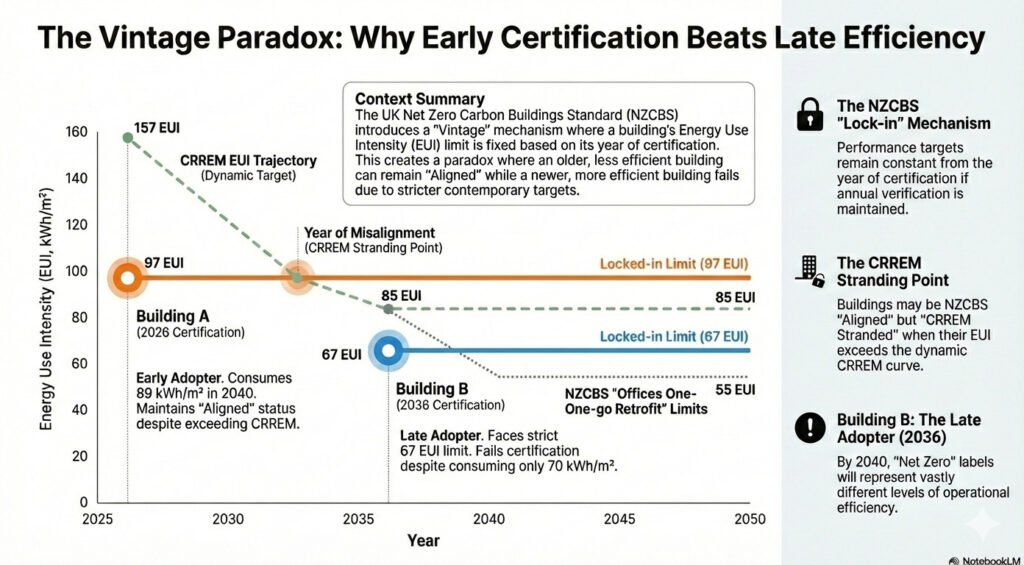

The “Vintage” Paradox: Strategic Lock-in vs. Long-term Stranding

The vintage or lock-in mechanism is the most critical strategic feature of the NZCBS for capital allocation. Under this mechanism, the specific EUI limit an asset must meet is fixed based on its initial year of certification or project initiation (NZCBS, 2026). Once an asset is verified against a specific vintage (for example, the 2026 limits), that target remains constant for the building’s lifespan, provided it maintains that level of performance through annual re-verification (Verco, 2026).

This creates a race to certify. An asset owner who achieves verification in 2026 locks in a performance target that is significantly more lenient than the targets that will face new entrants in 2035 or 2040. This provides essential investment certainty for landlords undertaking multi-million-pound retrofits, ensuring the goalposts will not move shortly after capital deployment (NZCBS, 2026).

Scenario Paradox The 2026 vs. 2036

Consider a narrative involving two identical office buildings on the same street. Building A (The Early Adopter) achieves NZCBS verification in 2026 and is locked into a limit of 97 kWh/m²/year. By 2040, it consumes 89 kWh/m²/year and retains its Net Zero Carbon Aligned status. Building B (The Late Adopter) with actual operational performance of 67 kWh/m²/year delays its intervention and seeks verification in 2036, at which point the limit has tightened to 67 kWh/m²/year. Even if Building B operates at a highly efficient 70 kWh/m²/year in 2040 (making it far more efficient than Building A), it will fail to achieve the Net Zero label because it missed its specific 2036 vintage target (NZCBS, 2026).

This paradox introduces a sophisticated due diligence risk known as Label Dilution. By the late 2030s, the Net Zero Carbon Aligned label will be attached to assets with vastly different operational realities. Investors must look beyond the headline label to the specific vintage of certification to understand the true operational expense (OPEX) protection and efficiency of an asset (NZCBS, 2026). Furthermore, while the lock-in provides protection within the NZCBS framework, it does not immunise an asset against other global benchmarking tools that track absolute performance.

Navigating the Multi-Framework Landscape: NZCBS, CRREM, and NABERS-UK

The current alphabet soup of sustainability standards has long created confusion for institutional investors. The UKNZCBS seeks to act as a unified technical rulebook, but it must be understood in the context of other prevailing frameworks, most notably the Carbon Risk Real Estate Monitor (CRREM) and NABERS-UK (NZCBS, 2026).

The relationship between the NZCBS and CRREM is one of divergence in methodology. CRREM operates on downward-sloping pathways that tighten every year, judging an asset against the limit for the current reporting year to identify a stranding point or misalignment year (NZCBS, 2026). In contrast, the NZCBS uses the fixed lock-in approach. This creates a scenario where an asset could be NZCBS Verified (meeting its 2026 vintage target) but CRREM Stranded because its energy intensity exceeds the dynamic CRREM curve for the year 2036 (UKNZCBS, 2026). While the NZCBS is the technical pass/fail exam for compliance, CRREM remains the primary tool for assessing long-term institutional liquidity.

In the office sector, there is significant harmonisation between the UK NZCBS and NABERS-UK. The 2025 EUI targets for offices (85 to 100 kWh/m²) are broadly comparable to a NABERS-UK 5-star rating (NZCBS, 2026). This alignment simplifies benchmarking for landlords and provides a clear signal to corporate occupiers that a high NABERS rating is a reliable pathway toward NZCBS verification.

Valuation Realities Quantifying the “Brown Discount”

The NZCBS provides the objective metrics required for RICS-compliant valuations, effectively ending the era where sustainability was a subjective add-on. Valuers are now explicitly considering the Standard when assessing asset value, particularly through its impact on Discounted Cash Flow (DCF) models (Hines, 2026).

The cost to cure (the capital expenditure required to bring an asset’s performance in line with the Standard’s trajectory) is now explicitly deducted from asset values. This is no longer a generic allowance but a specific calculation based on the gap between an asset’s metered EUI and the NZCBS limit (Savills, 2026). Furthermore, compliant assets may benefit from sharper yields due to their lower risk of regulatory obsolescence and attractiveness to high-quality tenants (NZCBS, 2026).

The market is increasingly bifurcated into Green Premiums and Brown Discounts (Hines, 2026):

- Green Premiums: Assets with high sustainability credentials, verified by performance-based metrics, can command rental uplifts of 6 to 11% as occupiers with their own science-based targets compete for limited compliant stock.

- Brown Discounts: Non-compliant assets face significant capital value depreciation, estimated at 20 to 30% in some cases, reflecting the risk of void periods and the high cost of eventual retrofitting (Savills, 2026).

Green Leases and the Verification Ecosystem

Verification under the NZCBS is a rigorous logistical challenge. To ensure the integrity of the market, the governance board has appointed Bureau Veritas as the Verification Administrator (CIBSE, 2026). This selection brings industrial-grade third-party auditing to the built environment, moving away from self-declaration. Bureau Veritas will manage the registry and conduct initial audits during a two-year exclusivity phase (Bureau Veritas, 2026).

To solve the liquidity problem for developers (the Developer’s Dilemma), the Standard includes an On Track validity check at Practical Completion (RIBAJ, 2026). This mechanism allows developers to demonstrate plausible compliance to investors and tenants at the point of sale or lease-up, even before the 12-month operational data cycle is complete. This check validates as-built embodied carbon using measured quantities (such as concrete tickets and bills of quantities) and assesses operational plausibility through forensic energy modelling (RIBAJ, 2026). It is essential for unlocking green finance covenants and exiting assets without a data lag.

The most significant operational hurdle is the Tenant Gap (Max Fordham, 2026). Because the Standard requires whole-building energy data, landlords must implement Green Leases with specific clauses (Better Buildings Partnership, 2026):

- Data Sharing: Mandatory clauses requiring tenants to provide energy consumption data to the landlord.

- Retrofit Cooperation: Provisions that allow landlords access to carry out decarbonisation works (such as heat pump installation) during the lease term.

- Circular Economy: Requirements for tenants to use low-carbon materials during fit-outs to protect the building’s embodied carbon profile (NZCBS, 2026).

Fund Management and Regulatory Alignment (SFDR & SDR)

The NZCBS could serve as the evidentiary bedrock for sustainable finance disclosures. By providing 12 months of verified data, it reduces the reliance on estimated Principal Adverse Impacts (PAIs), which regulators are increasingly scrutinising (NZCBS, 2026).

For fund managers operating under the EU Sustainable Finance Disclosure Regulation (SFDR), the Standard provides robust proof of alignment for Article 8 and Article 9 funds. Article 9 funds, in particular, require proof that underlying assets are genuinely sustainable; verified NZCBS data provides this evidence, supporting the fund’s alignment with the Paris Agreement.

In the UK, the Standard will likely serve as the de facto benchmark for the Financial Conduct Authority’s (FCA) Sustainability Disclosure Requirements (SDR). It supports specific investment labels (NZCBS, 2026):

- Sustainable Focus Label: This label requires at least 70% of assets to meet a credible standard of sustainability. The NZCBS provides the objective evidence base required to meet this 70% threshold.

- Sustainable Improvers Label: The Standard’s trajectory could allow fund managers to classify assets undergoing deep retrofits as Improvers, evidencing the ambition of the renovation plan without risking accusations of greenwashing.

Ultimately, the Standard could be an essential tool for Task Force on Climate-related Financial Disclosures (TCFD) and International Sustainability Standards Board (ISSB) reporting, allowing managers to quantify transition risks across a portfolio.

Looking ahead

With Version 1 of the Standard set for release in early 2026, fund managers must move immediately from intent to verification. The following three-phase plan provides a roadmap for implementation.

Phase 1: Baselining (2026)

The immediate priority is a data gap assessment to identify which assets lack whole-building metering. Managers should shadow rate their portfolios against the Standard’s limits to classify assets into three buckets: those already aligned, those with retrofit potential, and those that are stranded due to prohibitive costs or technical constraints.

Phase 2: Intervention (2026 to 2028)

Fund managers should prioritise assets for the Lock-in mechanism, securing early verification to protect against future target tightening (NZCBS, 2026). Investment Committee (IC) papers must be updated to ensure that no acquisition proceeds without a funded plan to achieve NZCBS verification.

Phase 3: Realisation (2028+)

Once the 12-month reporting cycles are complete, assets should be submitted for third-party verification. These verification certificates should be used to access green financing, such as Sustainability-Linked Loans (SLLs), and to differentiate the asset in the leasing market by highlighting verified low operational costs (Bureau Veritas, 2026).

In the new reality of the UK real estate market, the UKNZCBS is no longer a voluntary badge of honour. It could become the definitive market arbitrator, exposing obsolete assets while providing a clear, science-based pathway for those that will thrive in a Net Zero world.

References

- AtkinsRéalis (2026) Building the Future: The UK Net Zero Carbon Building Standard. Available at: https://www.atkinsrealis.com/en/engineering-better-future/beyond-engineering/uk-net-zero-carbon-building-standard (Accessed: 23 January 2026).

- Better Buildings Partnership (2026) Data Sharing. Available at: https://www.betterbuildingspartnership.co.uk/green-lease-toolkit/green-lease-clauses/data-sharing (Accessed: 23 January 2026).

- Buro Happold (2026) What is the UK Net Zero Carbon Buildings Standard?. Available at: https://www.burohappold.com/insights/what-is-the-uk-net-zero-carbon-buildings-standard/ (Accessed: 7 February 2026).

- Bureau Veritas (2026) UK Net Zero Carbon Buildings Standard Appoints Bureau Veritas for Administrator Role. Available at: http://www.twinfm.com/article/uk-net-zero-carbon-buildings-standard-appoints-bureau-veritas-for-administrator-role (Accessed: 7 February 2026).

- CIBSE (2026) UK Net Zero Carbon Buildings Standard is delighted to announce Bureau Veritas as the preferred bidder for the role of the Standard’s Verification Administrator. Available at: https://www.cibse.org/policy-advocacy/news/uk-net-zero-carbon-buildings-standard-is-delighted-to-announce-bureau-veritas-as-the-preferred-bidder-for-the-role-of-the-standard-s-verification-administrator/ (Accessed: 7 February 2026).

- CIBSE Journal (2026) Net zero’s mission possible? testing the UK-NZCBS pilot. Available at: https://www.cibsejournal.com/general/net-zeros-mission-possible-testing-the-uk-nzcbs-pilot/ (Accessed: 7 February 2026).

- Greengage Environmental (2026) Launched! First UK Net Zero Carbon Buildings Standard: what you need to know. Available at: https://www.greengage-env.com/launched-first-uk-net-zero-carbon-buildings-standard-what-you-need-to-know/ (Accessed: 23 January 2026).

- Hines (2026) Is There Value-Add in Energy Certifications?. Available at: https://www.hines.com/news/the-green-premium-and-brown-discount (Accessed: 23 January 2026).

- Max Fordham (2026) The UK Net Zero Carbon Buildings Standard Guide: Part 3: Operational energy. Available at: https://www.maxfordham.com/practice-people/journal/the-uk-net-zero-carbon-building-standard-guide-part-3-operational-energy (Accessed: 23 January 2026).

- RIBAJ (2026) Testing the UK Net Zero Carbon Buildings Standard. Available at: https://www.ribaj.com/intelligence/how-the-uk-net-zero-carbon-buildings-standard-works-for-architects/ (Accessed: 7 February 2026).

- Savills (2026) Will the new Net Zero Carbon Buildings Standard (NZCBS) impact the office sector?. Available at: https://www.savills.co.uk/blog/article/369212/commercial-property/will-the-new-net-zero-carbon-buildings-standard-(nzcbs)-impact-the-office-sector-.aspx (Accessed: 23 January 2026).

- UK Green Building Council (2026) Net Zero Carbon Buildings Framework. Available at: https://ukgbc.org/resources/net-zero-carbon-buildings-framework/ (Accessed: 7 February 2026).

- UK Net Zero Carbon Buildings Standard (2026) Pilot Version. Available at: https://www.nzcbuildings.co.uk/pilotversion (Accessed: 7 February 2026).

- Verco (2026) The UK Net Zero Carbon Buildings Standard – Part 1: Requirements. Available at: https://www.vercoglobal.com/latest/the-uk-net-zero-carbon-building-standard-part-1-requirements (Accessed: 7 February 2026).